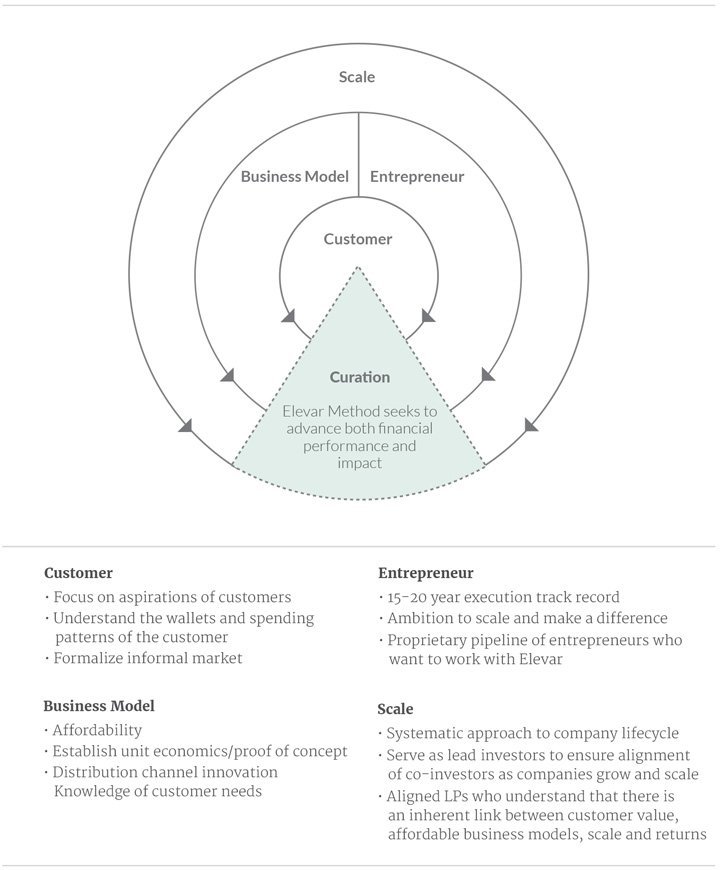

Elevar has always sought to identify investments where customer centric impact and commercial returns are aligned. In order to achieve commercial success that would inspire greater capital flows to serve underserved customers from low income communities, the Elevar Method of investing has been pillared on four distinct components: Customer, Business Model, Entrepreneur and Scale, with the Customer as the focal point.

Customer: Follow the customer and his/her wallet

In its decade of investing and consistent interactions with customers on field visits, Elevar has gained significant understanding into the needs, priorities, challenges, spending patterns and aspirations of large, low-income communities. The customer that Elevar supports has purchasing power (though limited), is often self-employed and acutely aware of economic opportunities and the arbitrage that exists in their communities. They are discerning about the products and services they consume and have demonstrated an ability to pay for products and services that fulfil their needs and aspirations. Spending time in the field is a core component of Elevar’s investment strategy, pre and post investments. Elevar remains diligent in understanding these needs and continues to follow the customer as their needs evolve and they evolve as individuals and as MSMEs. In 2015 and 2016, the Elevar team spent considerable time in the field visiting over 45 towns across seven countries.

Business Model: Invest in businesses that are margin-efficient and custom-built for the target customer segment

Elevar’s investment approach is re-orienting existing informal and socially coherent networks by delivering affordable products and services that meet pent-up demand – the real proof of impact for low-income communities. Elevar seeks to invest in business models that innovate to establish a high value and cost efficient distribution channel for their customers. Affordability for the customer is fundamental to achieving significant scale – this is alignment with LAhWS. At the core, these business models are designed to serve essential needs as defined by the customers themselves. They are predicated on creating enduring value at the customer, community and shareholder level. While creating long-term economic and social value they are also building a defensible proposition with limited disruption potential from newer players.

Entrepreneur: Back entrepreneurs who exhibit passion, execution experience and in-depth customer understanding

Elevar entrepreneurs typically come through proprietary networks that Elevar has cultivated in its years of investing. Similar to Elevar’s culture, its entrepreneurs are focused on bringing value to their customers, on eliminating inefficiencies and on understanding how to deliver more for less. Elevar commits a substantial amount of time to building entrepreneur relationships based on mutual trust and understanding. An Elevar entrepreneur demonstrates a motivation to improve the welfare of his or her customers, is operationally experienced and execution-oriented and exhibits an ability to build, motivate and lead large teams. We believe this is the key to efficient scaling of businesses and outreach to millions of customers.

Scale: Massively scalable solutions

With the affordability of margins as a key focus area for Elevar’s portfolio companies, it is scale that leverages the inherent size advantage of the markets that Elevar operates in, equating higher scale with both enhanced financial returns and transformational impact. By taking a systematic approach to company’s lifecycle (unit economics, institutional platform and scale) Elevar aims to generate high value, but cost efficient solutions for low-income communities. This is made possible through an aggressive focus on affordable margins, high efficiency and innovative distribution channels for scalability. Ultimately our goal is make risk-reward calculations that are based on the inherent link between customer value, affordable business models, scale and returns.

Curation

Cutting through each of the four components is Elevar’s ability to consistently curate environments for entrepreneurial success. Elevar’s portfolio management process leverages its team’s past experience and assists portfolio companies in areas such as governance, strategy (particularly with respect to customer value), recruitment and organizational development, identification of key operating and financial metrics that help scale a customer centric organization, and capital-raising. And last but not the least, Elevar serves as a partner through the lonely and challenging moments entrepreneurs inevitably face.

In conclusion, Elevar has found that the market intelligence gained by in-depth knowledge of the customer and their needs provides a material advantage in evaluating new investments. Furthermore, each investment theme is applicable to large low-income communities (millions of potential customers) across multiple geographies. The Elevar Method, or Human Centered Venture Capital, has mobilized over $900 million in equity capital from Elevar’s portfolio companies, which represents a 9x equity leverage on Elevar’s investments and approximately 75% of capital raised from commercial investors. The portfolio has touched over 20 million customers, created more than 50,000 direct jobs and over 7,500 different product distribution outlets across its markets.