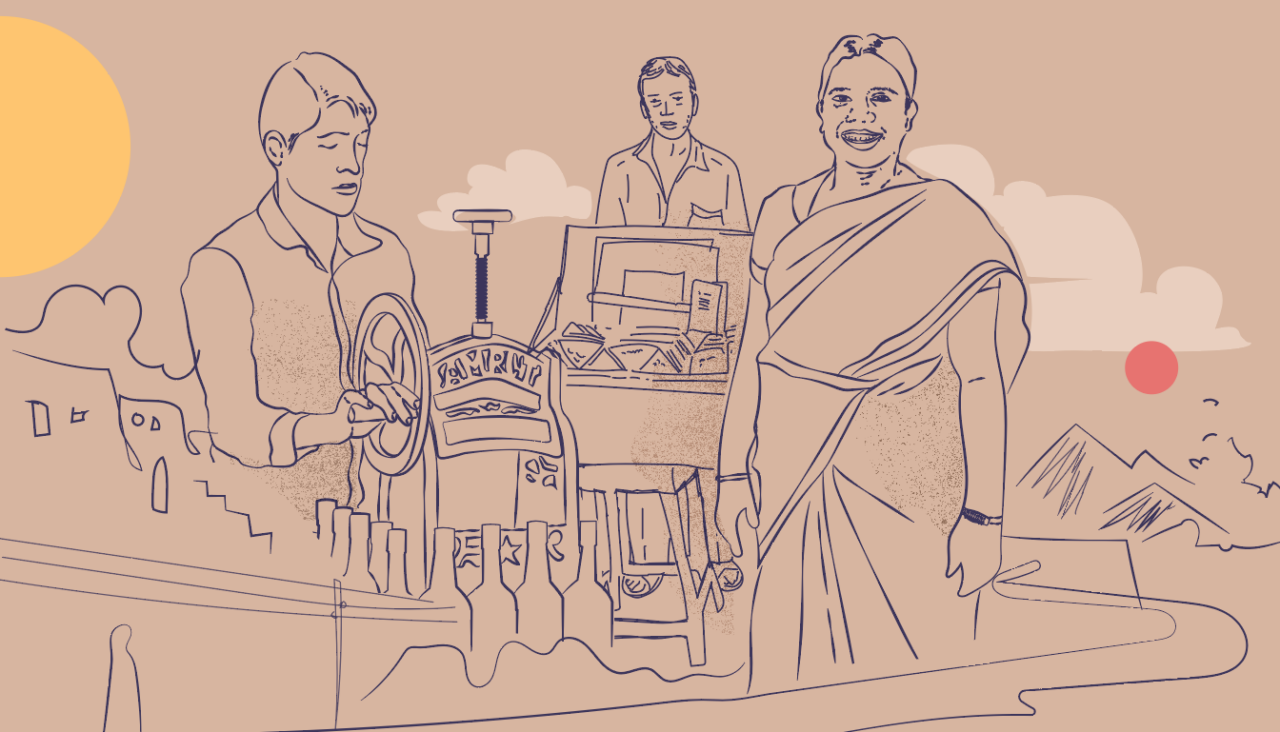

Innovation and growth are often in response to a challenge. And today some of the biggest challenges (and opportunities) in the world are related to inequity and a lack of access to basic essential services, for low income and underserved communities. At Elevar, as an early-stage and emerging markets fund, we seek to connect traditional capital markets with underserved customers. We invest in entrepreneurs developing scalable distribution models that democratize access to essential products and services for underserved communities.

Elevar makes relatively fewer investments in any given year. While this does not align with the status quo among most early stage investors, our decision to do so is deliberate. Why do we do so? Here’s why…

The core premise of our investment policy is customer-centricity that aligns shareholder interests. Our ambition is to ensure that portfolio companies have a concrete positive impact on the lives of millions of end customers. The funds we raise and manage aim to demonstrate and inspire capital to flow into business models that can fundamentally transform the way underserved customers have access to products and services. In the process, we make the hard choice of saying no to a lot of innovative business models and opportunities. Our focus is to do justice to the entrepreneurial journeys we have chosen to back, which keeps us fairly busy, with a significant portion of team and partnership bandwidth dedicated towards our existing investments.

Elevar’s investment in a company often traces back to a few years before we even meet an entrepreneur. Our investment journey begins not with a pitch, but with customer conversations. As we have written before, we spend a significant amount of time with the underserved customer segments in the field, getting a pulse of how they make decisions with respect to their wallet. We begin by asking ourselves, “What are the key drivers for a customer spending on this offering?”. Elevar is cognizant of the fact that these relatively small ‘spends’ of the customer define the potential for billions of dollars of revenues for companies looking to scale in this segment. As the market is massive, getting insights into the tangible and intangible ‘drivers of the spend’ is key for Elevar. For instance, recognizing just how important it was for low income families to spend a significant portion of income to enroll their children in better quality English medium schools as a way of securing their child’s future, was the reason for our investment in LEAD.

Elevar brings in the strengths of both the venture capital (VC) space, as well as the world of private equity (PE). However, since we go early, we are often asked if we take the same risk as a VC. The answer is actually quite nuanced, and so “yes” and “no”. Yes because many of our investments have been as founding investors where we have backed paper plans. Not with a $1M ‘option’ value check, but often with meaningful underwriting, representing a real commitment from the fund – a decision that involves detailed deliberation. The rigour of our ‘paper plan backing’ process is based on data points derived from the extensive amount of time our team spends in the field, and from a nuanced understanding of the world of capital through multiple cycles – over 15+ years of emerging market investing experience. As a result, our process is not based on full landscaping of all the start-ups and a call based on opportunities available, instead, it is driven by our internal view on how this market will play out – both at the customer end and the investor (and available capital) end.

We believe our chances of success are the highest when our independent conviction matches the founder’s (independent) conviction, which is why we prefer a two-way underwriting. It is not our idea they are implementing, nor are we simply “buying into” their pitch. Rather, it’s our mutual alignment and conviction on what it would take to solve the need-gaps of low-income group communities at a scale that moves the needle. For such a relationship of equals, we don’t want to be the only ones ‘underwriting’ the founders. We encourage founders to perform due diligence on us and choose us only if they believe we are the right partners, beyond the capital we bring to the table.

Ultimately, our underwriting of founders is not done on an absolute basis but a relative one: one, relative to other opportunities we are looking at like many investors, and two, relative to our view of ground realities. A long time is spent on assessing if the entrepreneur and Elevar will stay aligned through the journey – because our conviction in our entrepreneurs and the business model must go well beyond MIS reports, for us to be true partners in the journey. It is during the inevitable phase of glitches and tough phases that the alignment is tested. When it comes to the broader opportunity, we do not hesitate to shine a light on the internal gaps in companies and how entrepreneurs are dealing with these situations. While this characteristic is mostly appreciated by founders, sometimes it is not. In either case, it’s impossible to get everything right – but establishing the foundations for alignment undoubtedly makes this equation easier.

In essence, understanding Elevar’s investment as a package deal is crucial to establishing a successful relationship with our founders. We take each of our investments seriously and therefore want to ensure there is alignment with founders not just on the idea but also the underlying principles of our engagement. Over time, we have found that entrepreneurs engage the most in the context of organization design and leadership team building, raising capital, making strategic choices often in the customer context, and most importantly, as a partner in an entrepreneurial journey that is often lonely.

Our raison d’etre is that the funds we raise and manage, demonstrate and inspire capital to flow into business models that can fundamentally transform the way underserved markets have access to products and services. We are not driven by “FOMO” in terms of missing out on investment opportunities, as we are fairly engaged in a two way immersive relationship with the few journeys we have chosen. A majority of the team and partnership bandwidth is focused on existing investments driven by what our founders choose to engage us on.

In the end, our real success is measured by the difference between the field visits we made a few years before the investment versus those we start making as we head towards an exit. Have we eased some of the stress in the system around essential services? Have we inspired more entrepreneurs to start building similar models because the customer’s credibility is acknowledged by mainstream capital and business? The one thing we expect to see unchanged in these field visits, separated by a decade or more, are the smiles on the faces of the customers and their entrepreneurial spirit – these remain a constant 🙂